January! New decade! We hope you all are well.

First order of business — at this point, we’ve decided to send these newsletters more or less whenever we like. Hope that’s cool.

Second, hi. We’ve got lots to discuss as we write to you for the first time in a while. While our cadence of biweekly sends may be changing, our desire to pontificate at length isn’t. In this brief, we explore some predictions for the coming decade. If we're right, beers on you. If we're wrong, beers on us.

Fiscal Frenzy

As we present our first prediction, let’s establish that characterizing growth in global fiscal spending as a ‘new’ development would be a disservice to past years and decades. The current U.S. administration has run (and will continue to run) hefty deficits. China has long been at the forefront of doubling, tripling, and quadrupling down on infrastructure investment, be it on the mainland or elsewhere.

Still, as was perhaps most poignant during the rolling European economic crises of the late ‘00s and early ‘10s, many other governments have practiced austerity fiscally, regardless of monetary policy (more on that later).

Germany is a perfect example of past austerity. We also select it as an example because it may come to be at the forefront of shifting policy in the ‘20s. Earlier this month, Germany signed off on a new $86B investment in its rail network.

This comes amidst growing conversation in the policy community about whether monetary policy is up against conventional limits.

As writes Martin Eichenbaum of “unconventional fiscal policy”:

A hallmark of this approach is that it explicitly links the expanded use of fiscal policy to situations when we’ve hit the practical limits of monetary policy to fight recessions.

Whether monetary policy is really at an inflection point will be discussed in #2 below, but for this section, it suffices to say we believe the new decade will see past holdouts join the fiscal party, turning up the heat to spur elusive growth. The policy groundwork is already being laid by the “Don’t Sweat the Debt” crowd.

Monetary Policy Finds a Way

The last decade saw global monetary policy turn up dramatically. Interest rates are at a historical nadir and central banks from the U.S. to Japan have transmit strength to financial markets by acting as significant buyers of assets.

What will be surprising in this decade, by our estimation, is that there will be no monetary policy detente. Whereas we established in the #1 above that policy analysts tend to view 0% interests as an impasse beyond which central banks won’t dare lower rates further, we doubt any policy under the sun is immutable at this point.

See for instance the burgeoning narrative around a coordinated policy response to climate change (from ET):

If you’re keen to explore this further, here’s Christine Lagarde linking climate change policy and investment with the need to consider “different accounting principles” and substantial investment.

Further, Fed officials are openly weighing a policy we hypothesized we could see for the first time since the 1940s and WWII probably 10+ brief editions ago — namely explicitly capping or pinning treasury yields.

If you don’t see they’ll do whatever it takes, you’re not paying attention.

In the absence or even in conjunction with economic recessions, climate change may be the rallying cry by which central banks roll-out new policies, and, at the risk of sounding too conspiratorial, consolidate ‘emergency powers’. Or it’ll be some other tent pole. And when you see powers and policies extended even in what should be benign economic conditions (exhibit A), fear not. They can always increase in scale and scope.

Inflation, At Long Last

Combining predictions 1 & 2, the combination of loose and even heightened monetary policy with a turn to fiscal expansion as well will lead to inflation, whether or not its captured by traditional economic models.

Could we see a deflationary bust at some point after more than a decade of relative economic strength in the Americas and emerging markets? Sure. But we’d hang our hat on the ‘20s being a decade of more inflation rather than less.

We feel emboldened to say so because we’re perhaps already seeing green-shoots of inflation and growth, after many spent 2019 fretting about a recession.

For instance, inflation is picking up meaningfully in China and Canada already:

Remember, central banks are trying to create inflation. It’s one part of the Fed’s dual mandate. In a way, they’re at odds with you and & in that regard. Should things be this way? Perhaps not:

"Most Americans are more worried about increases in the cost of housing and medical care than they are about low overall inflation. Unlike the Fed, in fact, Americans do not seem to be worried about low inflation at all."

We’ll leave things here on this topic for now.

So What?

Here’s a prediction in which we could be wildly wrong, but based on what we outlined in #s 1-3, we think stocks are going higher in the near & intermediate term. Food, housing and healthcare prices aren’t the only things that can be inflated.

Will the fallout from the corona virus, or skirmishes in the Middle East, or impeachment proceedings produce short term sell-runs? Sure. That’s what’s happening today.

Still, as we have seen, the combination of monetary stimulus and a substantial fiscal deficit was rocket fuel for U.S. stocks in 2019, especially considering that conventional economic tailwinds were few and far in between.

The likeliest wrench in this neat little prediction of ours? Sanders as the Democratic nominee (which looks ever-more likely). The Sanders vs. stock market narrative isn’t out in full force yet, but it could easily be, and it has been; we saw stocks like $UNH trade down last spring when universal public healthcare chatter was all the rage. We could see this materialize again in a bigger fashion.

Note: we’re not taking sides politically, nor are we hoping for one stock price outcome or another. Lower stock prices can be good for those of us in the accumulation phase of our life (sorry, boomers).

The Bill Comes Due

We don’t know when, but at some point beyond the near term higher stock prices we called for in #4, the bill will come due. What do we mean by this? Let’s begin with an analogy (link here):

“…naturally occurring forest fires burn fast and rejuvenate the forest. If you suppress forest fires for a century (as we have done in the US), then when the forest does catch fire, it overwhelms our ability to fight it. Forest fires are increasingly bigger and more damaging to ecological systems, rather than the small contained fires that would naturally occur and burn themselves out. Economic systems are no different. Short, sharp recessions that reset the deck are healthy. Building up a generation of financial excess is destabilizing because the bubble will eventually pop—just like the monster forest fire eventually ignites.

We’re not here to fearmonger, but one effect of low interest rates and monetary and fiscal stimulus is that weak companies can stagger along, not on the merits of their profitability or growth or of their balance sheets, but on the coattails of positive investor sentiment and uber-cheap capital.

In good times? This acts as a leech on economy wide-productivity, but its passable.

In bad times? It’s like lighter fluid.

Perhaps even more concerning, not even the bastions of American capitalism seem able to resist the call of debt issuance at low rates. McDonald’s ($MCD) is a perfect example; it has issued so much debt in the past years that it has a negative book value (more liabilities than assets).

Will McDonald’s eventually get buried in this debt? Probably not.

Did they make life easier on their future selves, e.g. if rates are higher when they need to raise more cash? Probably not.

Populism & Protest

Uniting points 1-3, we venture to say we haven’t seen the last of the global populism wave. From France to Chile, 2019 was a year fraught with cost of living protests. As we left off with in #3 above, policy makers seem slow to recognize the transmission mechanism whereby higher prices cause unrest, especially when monetary policy uniquely benefits higher echelons of earners, widening inequality.

Broadly, world food prices reached a two year high in November. If there is a tried and true way to piss people off, that’s it.

Even where inflation isn’t rearing its head, should we be surprised that folks lean further left or right when policy makers emblematic of the political center openly discuss policies such as lending directly to hedge funds? The general public that doesn’t sift through Fed meeting notes for fun can’t exactly be expected to understand the rationale for such policies, can they?

Ways of Work

The way we work has changed drastically in the past 20+ years, and we expect the rate of change to continue to increase.

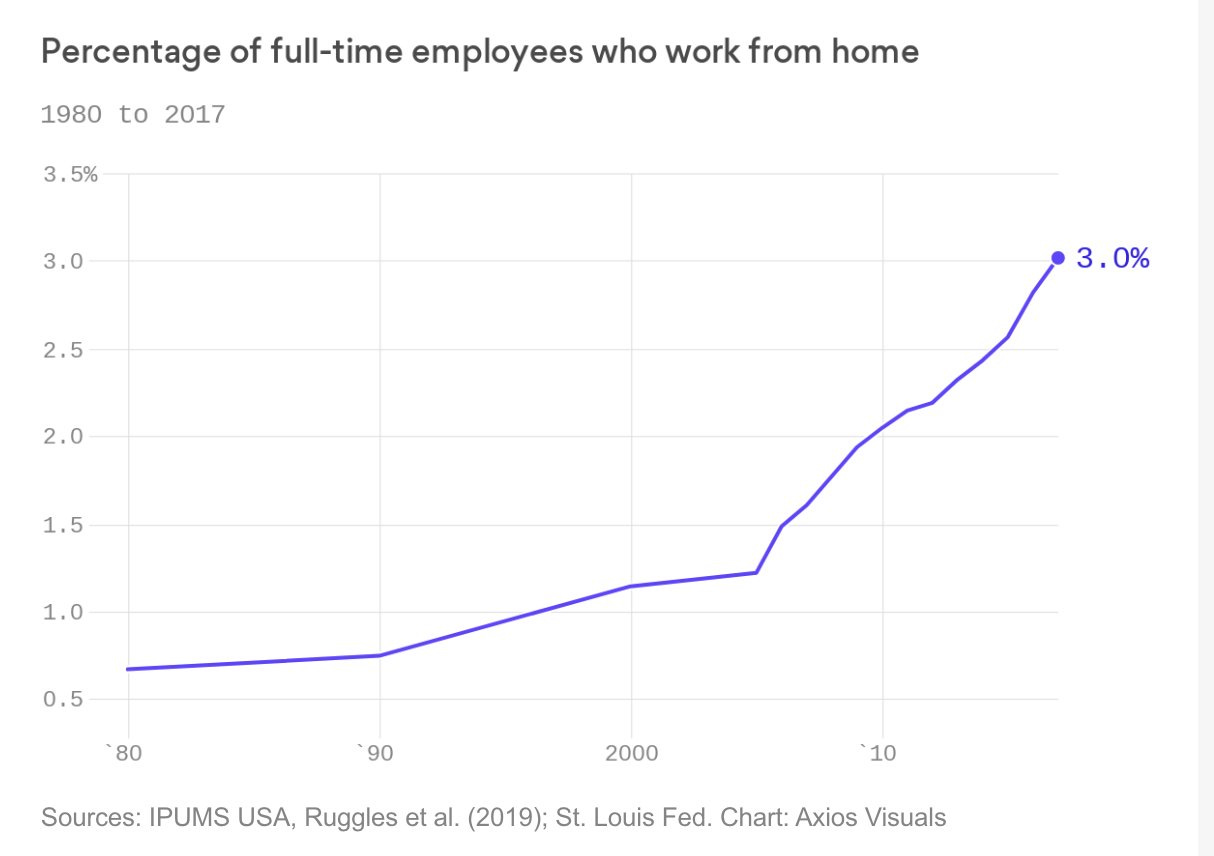

A simple example is below, where we can visualize the rate at which people move towards fully remote working slopes higher over time:

Whatever your preferred change to the way you work, whether it be about location, the type of work, means of collaboration, or technology leveraged, the train is leaving the station and picking up steam.

In and of itself, that observation isn’t that interesting. What we will be keenly focused on is the extent to which the ways we talk about the economy will be impacted. Think for instance about the flaws in current measurements of unemployment. In the U.S., people are counted as employed in general if they did any work at all during a surveyed period, regardless of whether that was an hour per week or 80 (@ Mark).

As we migrate away from a model of 9-5, stay-at-the-same-firm-for-20-years, not only will we need to embody and embrace more flexibility ourselves, but rigidity in old analytical models will need to flex as well.

(Side note, if today’s trends are any indication, we’re all going to be working longer too: 40% of

To that end, technology is no longer the gating item that prevents this flexibility. Despite the rapid influx of new project and task management software into the marketplace, the underlying infrastructure enabling “remote” has been around for most of the past decade (i.e., Zoom). What we think will continue to drive the change, in addition to demands from workers, is the simple cost advantages of having a distributed team. It’s up to employers and their employees to build work cultures that can thrive in that environment. If they fail, so will their companies (… or we’ll all be tossed back in cubicles.)

420 Blaze It

Cannabis will be federally legal by the end of the decade. We realize that this may be a tad contrarian as the state of the cannabis market is (*resists urge to say up in smoke*) in flux:

State tax revenues have missed projections as the black market continues to soar

Cannabis delivery marketplace and service comapny Eaze (crudely dubbed the ‘Uber for weed’) has burned through $165M+ in funding and might miss a payment on its next AWS bill

Investor sentiment (or speculation?) has fallen in recent months along with the shares of companies like Tilray (TLRY) and Canopy Growth (CGC).

All that said, with 11 states legalizing recreational use — Illinois officially legalized sales this January — we believe it’s a matter of when not if the federal government will join the band and #legalizeit.

Derivative hypothesis: If prohibition is not overturned, it will be because of negative medical research.

The Future of Computing

Have we reached the pinnacle of computing innovation? The history of computing is fascinating. From the days of Charles Babbage and Ada Lovelace’s Analytical Engine (the world’s first general purpose computer) in the mid 19th century to the supercomputers in our pockets that we check every 12 minutes, it is safe to say that computing has come a long way.

The evolution from Victorian-era machines that were essentially large calculators to mainframe computers to personal computers to mobile computers (aka phones) is one of the largest innovations in human history. But it’s not obvious what the next breakthrough is in computing.

While we anticipate processing and storage capacity of computers to continue it’s trajectory (no stance here on the controversy Moore’s law controversy), we hypothesize that there will not be any computing breakthroughs in the 2020s as significant as the growth of mobile devices over the past 15 years.

Areas like Internet of Things (in laymen’s terms: smart fridges), augmented reality, and devices like AirPods meanwhile represent large areas for innovation. No single device will outstrip mobile as the most dominant form of computing. But the aggregate mass of connect devices (be it the smart fridges, traffic lights, or surveillance cameras) is projected to balloon significantly (see below):

The best and brightest engineers and data analysts of this next decade will definitely still spend their time optimizing mobile to suck up your attention span. And at the same time, a lot of capital will be invested in people & companies capable of making sense of the data IoT devices will collect 24/7/366.

The New Kids on the Blockchain

No reflection on the past decade and prediction for the next would be complete without mentioning cryptocurrencies and the blockchain. The 10s’ proved that crypto is no joke, and as much as we like to poke fun, we are believers in their long term import as mediums of exchange. We can’t tell you which of the many coins will remain ascendent, be it a front runner (BTC, ETH) or a dark horse, but use of digital currencies is here to stay.

After all, Bitcoin may be down ~50% from its peak, but the long term price chart still looks like this:

Central bankers and governments alike meanwhile will try to stick their fingers in this honeypot in a big way. When assets are held digitally, rather than in cash or in physical assets, policy makers have even more tools at their disposal to induce spending (and keep tabs on you). For instance, negative rates can be imposed on bank deposits (see Germany), effectively taxing people or corporations for holding rather than using cash. If you want to pursue said policies wholesale, it helps if a higher (or 100%) of people’s cash is held digitally.

The bigger tension for the 20s’ then may lie not in the chances of crypto surviving, but between centralized and decentralized currencies.

Buckle up for the ride. We for one are strapped in.

That’s all for now, friends. We hope you have a great month-end and that you’re not short $TSLA.

N + M