Howdy friends,

*Tips cowboy hat in your direction.* Hope you’re all doing well.

You’re probably wondering what a SPAC is. Unfortunately, it’s not a self-powered air conditioner (it’s currently very hot in D.C. where one of us is writing this.)

We’ll get there after we check-in on the primary subject from our last note. & on intergalactic mining.

Up, up & away (like lumber prices.)

Checking in on the monetary game

Last week, Gold hit $2,067 (before cresting even higher). That’s exactly a 100x increase over it’s 1934 peg (back in the gold standard days) of $20.67 per ounce.

Since, gold + silver have pulled back as interest rates rise properly for the first time in what seems like months. Still, the overall relationship identified in our last brief holds. Namely, the stock market’s recent gains can be interpreted in the light of a depreciating $ (increase in the money supply), rather than on the merits of companies’ earnings or any economic strength.

To bear this out, we need only take a renewed glance at the S&P 500 to Gold ratio — which has continued to sputter in recent weeks — whereas the market in dollar terms has marched higher. In other words, measured against a more ‘stable’ currency, the S&P 500 continues to trade lower / flat. If we had chosen Bitcoin for our reference point, the chart would look similar (more on that later).

SPX to Gold Ratio:

But hey, don’t take the monetary thesis from us. Our favorite bald villain, Neel Kaskhari, characterized what has been going on with the U.S. Money Supply in recent months in even more blunt terms than we’ve used. To recap:

Can you characterize everything the Fed has done this past week as essentially flooding the market with money? — Interviewer

Yes, exactly — Neel

Further, we have other Federal Reserve officials signaling (i.e. directly telling us) that they’re prepared to let inflation run hot:

I would be comfortable with letting the cost of living run moderately above wages for some time. — Eric S. Rosengren, Federal Reserve Bank, Boston

In other words, they’re comfortable letting your purchasing & earning power depreciate to support financial & economic activity amidst COVID. Again, not suggesting this is right or wrong from a policy perspective. Just an observation.

Asteroid mining

Looking for a friend who is not comfortable with letting your purchasing and earning power depreciate? Say hello to Bitcoin.

Much like gold, Bitcoin has seen its fair share of price appreciation recently — + 27% in the last month. Unlike gold, Bitcoin does not face the same supply risk that faces gold when you take asteroid mining into account. Wait, what?

In case you missed it, the Winklevoss twins (Bitcoin billionaires, Gemini founders, and most notably the winners of a bitter lawsuit with Zuckerberg over Facebook IP) gave Barstool sports founder Dave Portnoy an of-the-moment introduction to crypto. Beyond explaining the basics to Dave, the twins alluded to Elon Musk’s plan to mine precious metals in the cosmos, a plan that could introduce inflation to an asset class once considered finite (gold). The conspiracy theorists in us love this one, even if we don’t love Elon. Here’s a 3-month BTC price chart for you:

Sticking to something more terrestrial — why does this matter? Portnoy’s video alone has over 650K views, and it speaks to crypto becoming a staple of modern culture. The data support this:

Earlier this month, $30B of Bitcoin was transacted per day — double the trading volume seen around the time of the historic 2017 run.

Square generated $875M in Q2 revenue from its Bitcoin trading service — a whopping 600% YOY increase.

While one might get the impression that it’s just cryptopunks and day traders looking for action, P2P Bitcoin trading volume in Latin American and African markets continues to steadily increase.

The applications and potential benefits are starting to become apparent here, and we are frankly excited about the future of Bitcoin. Especially in a time when our central bank is printing dollars like crazy.

Anyways, enough ranting about inflation, currencies, & asteroids. What’s a SPAC?

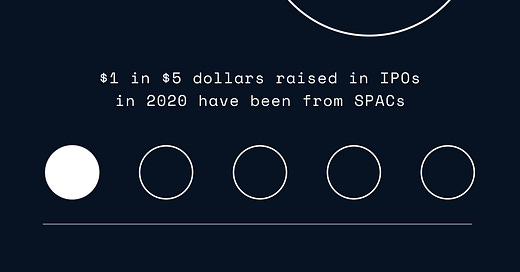

Once you go SPAC, you never go back

SPAC stands for Special Purpose Acquisition Company. Which still tells you nothing.

In a sense, going public via a SPAC is a little like cutting in line.

Traditionally, companies go public via an Initial Public Offering (IPO) on a major index (e.g., the Nasdaq). They get the glitz and the glam, they get to ring the opening bell on the trading floor, heck, they might even get to hoist a huge banner in front of the stock exchange, much to the glee of their marketing department.

The downside?

Stock exchanges require a lot of diligence as part of the IPO process.

IPOs can also be a lot more expensive than SPACs

SPACs are less risky – you sign a deal for a fixed amount of money – whereas IPOs leave more to be determined by the market

As for what a SPAC actually entails, see as follows:

Raise money from the public markets for a fund, instead of your company

Find a company to merge with (ideally a small, unobtrusive one)

Merge

Voila, now you have access to public markets, and you’ve raised some money through what is effectively a deconstructed IPO.

You were also likely able to move more expediently, without a lot of the fanfare and perhaps importantly in your case, scrutiny.

Why is a SPAC wave happening now? In part because companies want to get to the public markets fast. Why? Because of what we’ve been exploring over the past two briefs. CFOs and investors everywhere see their friends getting rich in markets juiced with Fed stimulus. And they want in on the spoils, too.

To fairly represent other arguments for why the SPAC boom may be happening:

Some also theorize that the SPAC boom is accelerating due to Covid-19 because IPO roadshows are hard to do and don’t work as well remotely. So there is a shift toward one-on-one deals rather than one-to-many capital raises. While this explains 2020, the increased popularity of SPACs is just a continuation of a decade-long trend. — Byrne Hobart (article here)

Drawbacks to SPACs include the absence of the traditional branding moment that surrounds an IPO. Similarly, SPACs are less of an option for large companies, a la Airbnb, as it’s more difficult to raise big fundraising rounds than it is with an IPO.

Still, notable companies have conducted listings by SPAC recently. You may not have heard of Nikola, but you’ve probably heard of DraftKings and Virgin Galactic.

They did the SPAC. And based on their stock performance so far, they’re probably not going back.

That’s all for today, folks. We hope you enjoyed and look forward to the next one.

As always, we appreciate u,

N + M