mo money mo problems

"I don't know what they want from me / It's like the more money we come across / The more problems we see" — The Notorious B.I.G

Hi, Nick here.

Back from a four-month hiatus.

I paused the newsletter writing for some time for three reasons:

Bigger things going on

Not knowing what was going on

Too many things going on

For one, I felt like much of what is and has been happening, whether in markets, changes in the way we work, and lest we forget, a global pandemic, was more important to observe than anything else. When it came to protests about racial injustice, I strongly believe there are more qualified voices making cogent, important, noisy arguments that you’d be better off spending time with than mine.

I believe that about markets to a lesser extent. Said differently, I still think I have something to add in those spaces. And so we resume.

With some qualifications however. The second and third reasons I paused writing for some time owed more to a general business level with a work schedule that has more or less blurred entirely wit the rest of my life. As has been the experience for many of you I’m sure. I also frankly didn’t feel capable of putting my arms around the universe of things I could possibly write about any given week.

Income inequality? Inexplicable booms in individual stocks? Unemployment and a never-before-seen labor crisis? Pick your favorite.

In German, there’s a cold-era war term worth mentioning here. Strategists of the era needed terminology to describe the worst possible thermonuclear event (imagine nukes flying left and right, extinguishing life as we know it on the planet.)

Ok, yes. This is getting a bit dramatic. Bear with me for two secs. The term they came up with? Super GAU. Here, GAU stands for größter anzunehmender Unfall. In English, that’s loosely “the biggest possible accident” or “event.”

That’s what the past few months have felt like. The biggest previously imaginable cluster of disparate events, all of which on their own could fill history books’ annals. Some of this feeling owes to the amplification of our media, but that’s a separate topic.

Out of this experience, namely of simultaneously not having many man hours and feeling like there are 1 million things to do or think about or write on pulling me in all directions, I came to one valuable lesson for the pandemic so far.

To bring any consistency to this newsletter will require significant restraint. Really, any endeavor these days does. Our sandbox narrows.

From now on, we’ll write about one overarching topic per newsletter. No more, no less. It’s my elevator pitch of what I think you should know about markets and investing, or the world, for that week. Or in this case, for the last four months.

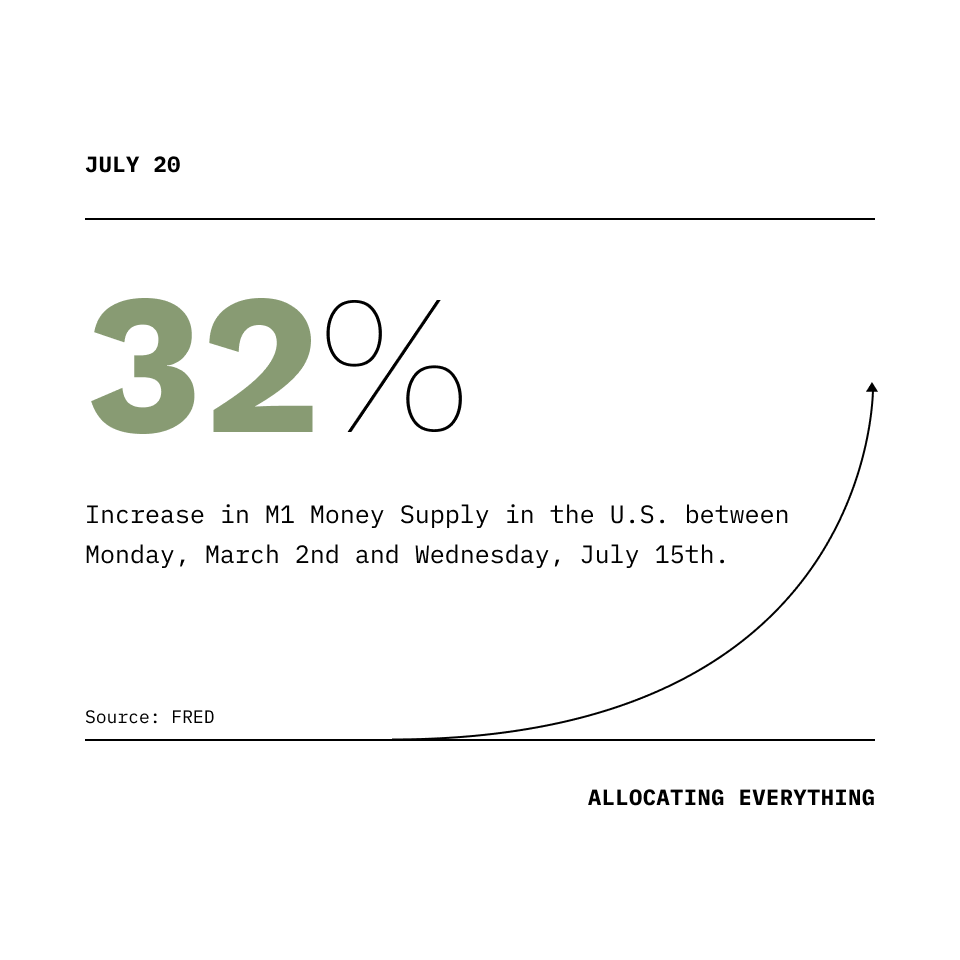

Nor will I bury the lede. I want you to know that since March 2nd, 32% more dollars have come into existence in the world. For every $100 there were in March, there are now $132 in mid-July.

*M1 money stock: M1 includes funds that are readily accessible for spending. E.g. currency outside the U.S. Treasury, Federal Reserve Banks, and the vaults of depository institutions; (2) traveler's checks of nonbank issuers; (3) demand deposits; and (4) other checkable deposits

If you’ve cast an eye at markets recently – and I wouldn’t blame you if you’re attention has been elsewhere, or if you’ve gone with the ostrich-head-in-sand approach – you may notice that things have gone, well, berserk. On June 3rd, we officially capped off the strongest 50-day bull run in the history of markets.

Meanwhile, the economy remains in tatters.

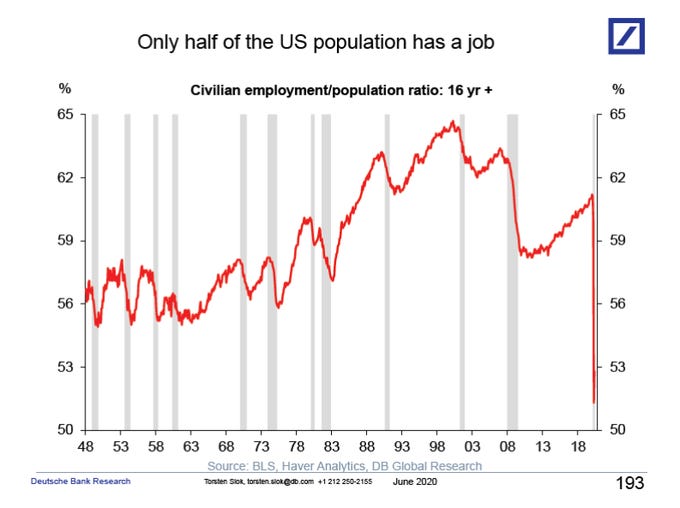

Nearly half of the country doesn’t have a job right now.

Child hunger reached levels 3x higher than the worst of the Great Recession (link)

Among people who were working in February, almost 40% of those households making less than $40,000 a year had lost a job in March (link)

Despite all this and the prospect of more shutdowns, U.S. equity indices are closing in-on, if not already beyond, their all-time high watermarks.

This is seemingly beyond all reason.

Two possibilities come to mind:

Our current stock market ‘regime’ either permanently dispels the notion that market movements are a function of economic fundamentals, like growth, innovation and inflation, at least in the short-term…

Or we are already experiencing substantial inflation

Let’s return to the point of the money supply.

To reiterate, the money supply in the U.S. has increased 32% since March.

The amount of dollars in our country has undergone a drastic sea change in a very short amount of time. Where has all this money gone?

If it were in people’s pockets, and actively being spent on consumer goods or electronics or real estate, we would be hearing about it in terms of inflation. The type of inflation Bloomberg and the Federal Reserve talk about ad nauseam that is. Inflation, at it’s core, is too many dollars chasing too few goods. That’s not happening, at least not with respect to TVs, and wouldn’t unless aggregate demand recovers meaningfully.

By no accounts are markets for the exchange of physical goods or services flush with cash. The economy is almost assuredly limping along or shrinking even more as I write this. Plus the savings rate in the U.S. has skyrocketed (for those who still have dollars to save)

Without ferreting out and following every dollar, it stands to reason that a lot of new dollars that aren’t being husbanded in deposits have trickled down to find a home in financial assets. Be it bonds, stocks, gold, what have you.

If you look at meteoric gains in stocks like Tesla and Amazon, which, on their surface, are indeed quite spellbinding, with the knowledge that we’ve had a 32% increase in money, things become more comprehensible. At least they do to me.

We talk about currencies or precious metals as store of value. I.e. things that will be worth about the same amount of other goods or services in exchange, regardless of whether you make said exchange now or in 10 years.

But what happens when 30% more of your store of value is introduced effectively overnight? When the money supply grows faster than the economy, of necessity, some form of inflation is happening. Even if we don’t see it in the housing or food or energy prices. (I’m not trying to present this as fact. It’s a contentious opinion, but I stand by it.)

If one store of value has been inflated by 30%, won’t people flock to other stores of value? Shares of stock, claims to pieces of a company with real assets, IP, recurring streams of cash, etc. can be fair stores of value too. Sure, they’re more speculative, but they can also offer growth when things go well. And if you pick well-managed ones, their financial departments won’t dilute you by issuing a ton of equity any given year.

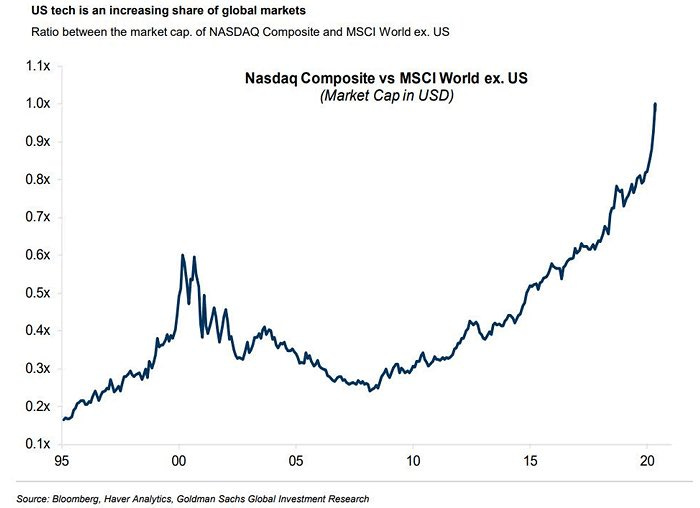

Further, arguably top innovators / companies with the highest growth rates offer the best store of value in an inflationary environment. Their growth stands a chance of matching or exceeding growth in the money supply. And low and behold, this is where stock gains have been accruing to:

Suddenly the bidding up of financial assets, especially high growth tech, as an alternate store of value, doesn’t seem so crazy after all.

Lastly, if we price the S&P 500 in gold, and in doing so loosely control for financial asset inflation, things don’t look that weird. Actually, the SPX to gold ratio tracks recent economic growth in the U.S. pretty well (post tax-cut boom, followed by a secular slowdown starting in 2018, and intensifying demand-shocks in Q1 of this year with the pandemic + lockdowns).

Nice. Thanks, Nick, you say.

Should I care? Will my savings in dollars be worthless in ten years?

With respect to the latter, I’m reasonably certain they will be worth less.

With respect to the former, and to circle back to where I started this brief, I don’t blame you if you don’t care. There’s a lot else to care about right now.

But, if you are like me, and you are fortunate enough to be healthy and to have a small nest egg of financial assets, you should duly consider the longer arc of what we’re witnessing. What are the downstream and second order effects of this?

I’ve identified one first order effect in the stock market’s response.

Maybe a second order effect is significant civil unrest. Beyond heinous murders caught on camera, aren’t people fed up with the owners of capital endlessly getting richer and richer? Elon Musk got $6 billion richer. Last Friday.

But that would take us beyond the bounds of this edition.

More to come,

N

P.S. — remember to share & have folks subscribe. I appreciate u :)