Pictured above? Not a Tesla.

What we’re discussing today? Tesla.

Hope you’re all well. It’s been quite the stretch, from Iowa and New Hampshire to Wuhan. In markets? Relatively calm, as equity indices shrug off concern after concern.

Under the hood however there have been some earthshaking moves of late. Few have been as spectacular as Tesla’s recent run. Today we’ll dig into the anatomy of this vicious stock price move.

Not interested? That’s okay. You can get off the ride here and nav to Elon Musk’s newest soundcloud track instead.

What’s a Squeeze?

You’ve probably heard of short-selling, where investors of a certain bent decide to bet against a stock. The mechanics can be a bit complicated to understand, but essentially, you borrow someone else’s stock. You then sell it at its current price and hope it declines from there so you can buy it back for less later, netting a profit when you return the share(s) you borrowed.

In any case, when it comes to companies that a large cohort of investors think are shit, you can find cases where a significant portion of the company’s stock is ‘held short,’ which is to say borrowed for the purposes of short-selling. The number of shares held or sold short is also referred to as “short interest,” and can be expressed as a percentage of the total number of the companies’ shares.

What can then happen is that a rise in price or other catalyst can initiate a ‘short squeeze’. Effectively, if a stock’s price rises sufficiently, short-sellers may get sick of getting their asses handed to them, and may ‘cover’ or buy back the shares they originally sold. If this happens en masse, it can lead to significant moves.

And that’s where the term “short squeeze” comes from — stock goes up, short sellers get squeezed out, stock goes up even more. Perhaps the most famous short squeeze came when heavily shorted VW briefly became the world’s most valuable company in the middle of a major squeeze.

A squeeze is definitely not the entire story when it comes to Tesla’s most recent parabolic move from ~$300 as high as $1,000. No one knows what other factors are at play here yet, outside of some good ol’ fashioned investor euphoria.

Still, as laid out in the chart below, you can see a clear relationship between price increasing and short interest decreasing; millions of shares that were held short were bought back in the last month(s), contributing to the stock’s gains and trading volume.

Financial fundamentals certainly don’t appear to be the primary consideration here.

Tesla lost $862 million dollars in 2019 on a GAAP basis, and its Chinese manufacturing capacity is likely taking a hit given coronavirus production constraints (Chinese car sales are down 92% in the last two weeks).

For a bit of na underlying financial contrast, note that at the height of its rapid appreciation, Tesla was valued more than Oracle.

As noted Tesla posted a loss of ~$1B in 2019…

…whereas Oracle turned $10B of profit in 2019

Tesla’s valuation has even approached Toyota’s in recent weeks, even as Toyota sells 27x more cars.

As is often the case in a market that is not necessarily as efficient as billed, narratives about companies can be just as powerful as their financials or competitive advantages. Elon Musk is a master story-spinner. He endlessly (and convincingly) paints pictures of a rosy future, regardless of whether his claims ultimately come to fruition. See below for an example of how this can play out.

In Tesla’s case, there are actually two mutually exclusive narratives that divide bulls and bears into camps perhaps more starkly at odds than in any other corner of the market. There are esteemed financial professionals like Cathie Wood, who sees Tesla shares climbing to $15,000 (based on a future fleet of millions of autonomous Tesla taxis that will outperform Uber and Lyft.)

Others, equally esteemed, think the company has fraudulent accounting practices and that shares will decline to zero (e.g. Josh Wolfe, David Einhorn).

Our takeaway?

Don’t hold your beliefs (or your positions) too firmly in a market driven by stories as much as by financial statements. Lest it cost you your capital + the shirt off your back.

For now, the ‘Elon is a genius’ camp is doing all the celebrating.

Wild price accumulations — e.g. the ones we saw in weed stocks and Beyond Meat in 2019 — aren’t unheard of for smaller companies. But for a $100B+ company, moves like Tesla’s, which saw the stock’s price more than quadruple from its 2019 lows, are quite rare.

And this has been a truly record setting rally — as visualized below, on an otherwise uneventful day earlier this month, Tesla set a record for volume of dollars traded on any given day ($34.5B in Tesla shares traded hands).

Writes Felix Salmon of Axios:

In the first three days of (that) week, $157 billion of Tesla stock changed hands. For gamblers, it was more popular than Bitcoin, which saw $96 billion of volume in those three days. Tesla even approached the $198 billion of volume in SPY, the benchmark S&P 500 ETF that's the most popular playground for day traders.

And Tesla isn’t the only company that’s gone more roulette wheel of late.

Virgin Galactic ($SPCE) has skyrocketed even more than Tesla so far this year. To be sure, it’s a much smaller company, which makes rapid price moves easier, as noted above. As is the case with Tesla, the lack of external catalysts to explain $SPCE’s rapid ascent is perplexing. Reddit users think they’ve created a “perpetual money printing machine,” as one user exuded. We’re not convinced.

While Virgin promises the prospect of commercial space travel at some point in the future, it’s had day traders moonbound in 2020. We’ll see if this all ends in a major rug-pull. It usually does. We wouldn’t get too used to 15% up days.

Around the World

Now that we’ve discussed Tesla and Virgin Galactic ad nauseum, let’s take a gander around the rest of the world, shall we?

Beyond the political circus in the U.S., the coronavirus has hogged a lot of headline space in the last month. And it will likely have widespread effects, despite markets mostly shrugging it off (so far). Just today the CDC shifted its tone, saying the virus presents a “tremendous” public health threat.

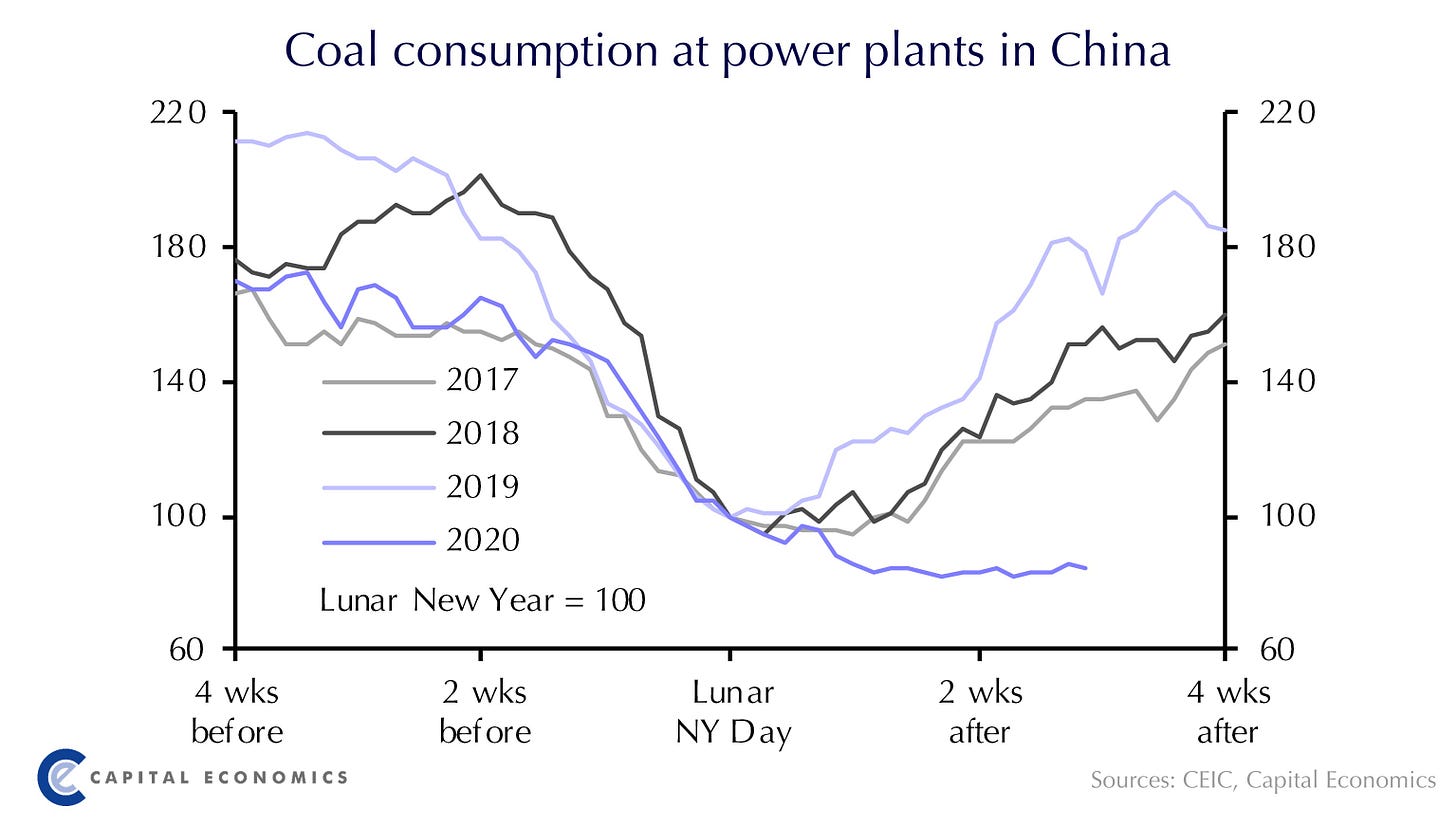

For one, in its effort to contain the virus, China’s society (and economy) is grinding to a halt. That’s at least how things look based on the country’s YTD coal consumption (pictured above).

Meanwhile, Apple was the first major company to report that its supply chain would predictably suffer from labor shortages in China, as the country hunkers down in quarantine. Here’s a not so bold prediction — other companies will follow suit.

In fact, there have been plenty of others already. With so much hitting the media news cycle each night however, the below types of pressers don’t always get air time:

A similar story hit…yesterday for Puma – who reported half their stores in China being closed – and Adidas, who reported an 85% drop in sales compared with the same period last year. And that’s just sales impact. (source)

If you were a CEO looking to sneak a ‘kitchen sink’ quarter past investors (which is to say, a shitty one), the coronavirus is probably your perfect cover to do so.

More on that idea here.

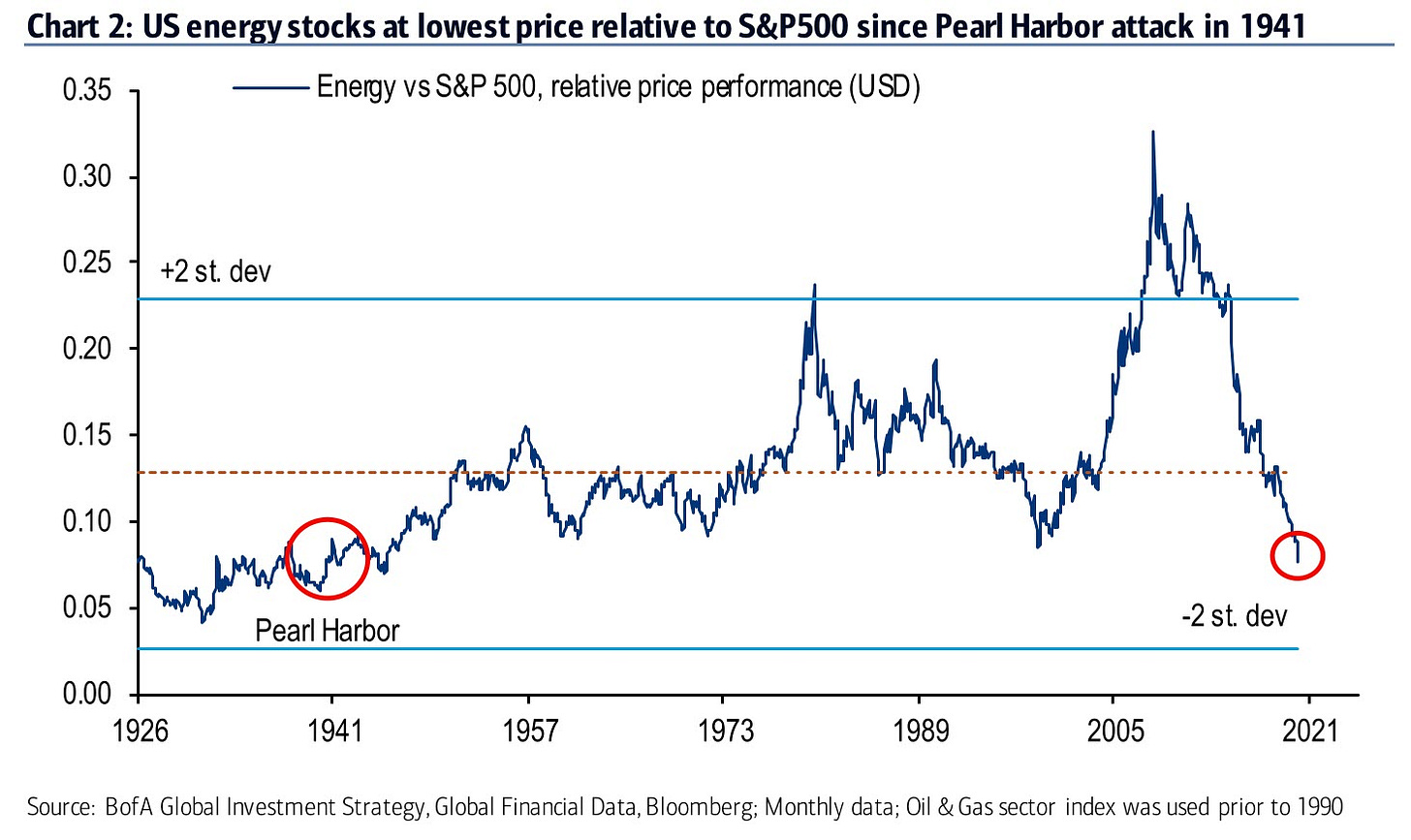

One sector that’s already on death’s doorstep, and where coronavirus certainly isn’t helping, is in energy. With oil prices staggering amid continued global growth concerns, U.S. energy stocks are at their lowest relative level compare to the broader S&P 500 in a long time. A really long time:

Still, things as a whole are alright over here in the friendly confines of the U.S., where nothing appears to dampen the economy’s albeit slow chug forward. In the face of perennial calls for a recession because, well, ‘it’s been a while’, measures of economic sentiment in the U.S. continue to surprise to the upside. On Thursday, the Philadelphia’s Fed Index, a measure of sentiment in the region, surprised higher, big time:

This isn’t necessarily great for stocks however. With the rest of the world in disarray, the U.S. is a refuge for global investor capital. As money flows into the U.S., the dollar strengthens, which makes U.S. companies’ goods more expensive for foreign buyers, and which puts major pressure on emerging markets with dollar denominated debt.

In short, a stronger dollar can hurt global growth. This can become reflexive in the following way:

Strong dollar = lower global growth

Lower global growth = stronger outperformance by the U.S.

U.S. outperformance = stronger dollar

Here’s the dollar chart of late. Looks more like a tech stock, straight up:

A possible solution? More Fed rates cuts. We’ll see!

That’s all for us (and likely all for February). We hope you’re having a great Q1.

Much love,

N + M