Happy December y’all,

With the holidays around the corner, this will be our last note for the year. It also happens to be ~ 2 years since we first started this endeavor. That’s longer than most people our age stick with a job, so a little self-congratulation is in order. *Pats back vigorously*.

As we wrap up the year and the decade, we’ll take a straightforward approach to today’s note (for once). Here are our top 10 stories for markets in 2019 (and prior). *Queue Sports Center soundtrack*

10 Need to Knows for 2019

Returns recap (as of 12/6, 10 year measures start 1/1/2010):

S&P 500 1-year: 19.48%

S&P 500 10-year CAGR: 11.7%

I.e. $1 (w/ dividends reinvested) grew to $2.70

Bonds 1-year: 19.44%

Bonds 10-year CAGR: 6.3%

10-year yield now: 1.843%

10-year yield on 12/31/18: 2.67%

10-year yield on 1/1/2010: 3.825%

Oil 1-year: Flat

Times the President tweeted “enjoy” in reference to stock market gains as if they were a meal: 2

There was no Inflation (or so “they” say)

Over the weekend we read an article that stated “We now live in a different economic universe than we did before the crash. Falling unemployment no longer drives up wages. Printing money does not cause inflation.”

Jerome Powell also announced today the Fed wouldn’t raise rates until they see meaningful indication that inflation is picking up towards their 2% target.

Is bullet one true? Is inflation actually low?

These are certainly common economic conundrums of our time: Why is inflation so low on paper in developed economies that for the better part of the last ten years have been printing money like crazy? (E.g. Japan).

The rest of the article explores deficiencies in current economy theory, which is all well & palatable. But even as a passing intro, it’s myopic to confuse a 10 year absence of something, only in specific countries mind you, with it something being gone forever.

Zimbabwe saw 300% inflation this year (after printing a lot of money). There have been cost of living protests in more countries than we can count over the past months, from Chile to Iran and Paris to Quito.

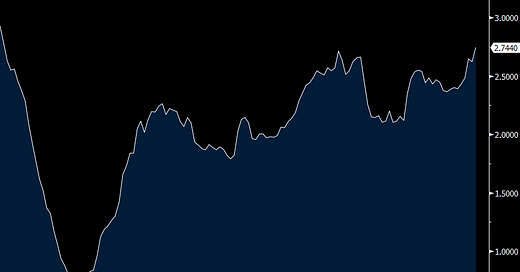

So, is the boogeyman of inflation actually gone forever in the U.S.? We don’t know. See below for a chart of the Atlanta Fed’s ‘sticky’ (sans volatile components) core CPI. It’s at an 11 year high.

Printing Presses = Back On

As we alluded to above, 2019 also saw global central banks resume stimulative monetary policies. In some countries like Japan, these policies never really stopped this decade.

In the U.S. at least, the Federal Reserve spent 2018 increasing interest rates (more on this later). At the end of 2018 further rate increases were paused. But this year (starting in July), the Fed lowered rates again, as the narrative drumbeat of an incoming recession grew louder (more on this later too).

Now, in the fall, the Fed has started expanding its balance sheet again (buying assets in & providing cash to various markets).

Both of these monetary policies are stimulative to asset prices.

They’re also drivers of inequality, however.

As much as inequality is a structural problem, monetary policy, in the manner conducted by most banks, doesn’t help.

As writes Robert Skidelsky, specific about the Bank of England:

…the Bank of England began printing money like mad and, effectively, handing it out to the one percent in an unsuccessful attempt to kick-start inflation. The practical results were, to put it mildly, uninspiring. Even at the height of the eventual recovery, in the fifth-richest country in the world, something like one British citizen in twelve experienced hunger, up to and including going entire days without food.

To 0 and beyond

As you may have surmised from the 19+ % return bonds posted this year (see #1), interest rates continued to decline in 2019.

Rates in the U.S. have now been in nearly unimpeded secular decline for 30+ years.

Today the Fed also announced it wouldn’t be raising rates for the foreseeable future.

That’s a pretty sweet set-up for anyone who started their investing career during this time span.

It’s also good for borrowers and keeps the gears of the economy greased with cheap credit.

Still, many, including us here, regularly wonder aloud whether rates should be hire to require a meaningful hurdle rate for investments.

I.e. if rates were 10%, investors might not have piled into WeWork at the same voracious clip that they did with rates at 1%.

That said, outside the U.S., especially in Western Europe, there’s plenty of places where government rates are less than zero, as central bankers desperately try to coax consumers to invest in the real economy.

Tying some above bullets together, maybe someday we’ll realize that reducing rates below a certain point actually becomes a disincentive to productively invest.

After all, in a low rate environment, managers can meet their EPS goals by taking out debt & buying back shares, rather than investing in capitally intensive (“productive”) projects.

In any case, interest rates in the U.S. weren’t the only thing that continued their path towards in 0. Many (if not most) consumer brokerages also slashed their commissions to $0.

We’re oft cynical, but beyond the fact that brokerages still make money off us by selling our data (more later), this is a win for the every day investor.

P.S.: we’re ready for the < 0% mortgage rates in the coming decade.

Venture Capital Chugged On amid a few Flare-outs

Venture capital is weird. Frequently tweeted about and critiqued, folks often note the lagging performance of the asset class vs. public markets. But here as in elsewhere, patience can be a virtue! Most funds take 12 years to fully liquidate. (It's also called 'venture' for a reason. This isn't your grandpa's muni portfolio).

Pay attention to the early hints: 1/2 of all funds make a distribution by their 1.5 year mark.

LPs are still long the asset class (in part driven by the fact that companies are staying private longer) with $30B raised by VCs each of the past 5 years.

And investors are investing. 2019 will mark the second year in a row with +$100B in venture deal value.

But deal volume is declining. The result? We expect enhanced competition and are curious to see how this puts further upwards pressure on valuations.

Reminder: people that don't look, speak or think like you are not inherently bad. Over half of private US unicorns have 1+ immigrant cofounder.

China showed signs of struggle while the U.S. “poodles” along

Discourse about the trade war is reactionary for the most part, so we typically steer clear.

The one piece will add is that in sum, the Chinese economy is likely more at risk of fallout than is that of the U.S.

China is far more indebted than the U.S. is:

China = 300% + of GDP

U.S. 100% + of GDP

Two Chinese firms just missed bond payments totaling more than $.5B.

China’s foreign currency reserves have also been falling fast as they focus on managing the yuan, as the dollar remains the strongest currency in the world through it all.

In the words of David Bloom: “Meanwhile the U.S. is ‘poodling’ along quite nicely; the economy is doing okay…”

‘ESG’ garnered more attention in parallel to climate change’s media share

There are lots of people who are taking ESG (Environmental, Social, Governance) factors seriously in their investment allocations.

Take CalPERS, which divested from two private prison companies last month.

Similarly, corporations make policy changes much faster than politicians do these days:

But don’t be easily conned. For others, ESG is just another glitz & glam fad to gather your assets.

With commissions going to $0 (see #4), brokers now make all their money selling your data and your order flow. More than ever, their goal is to amass as much of your money in their accounts. What better way to get 20 somethings to invest with you than to offer them a ‘green’ ETF?

It took us 18 seconds to find a ridiculous example: Exxon Mobil is the 7th largest holding in the “FlexShares… ESG Impact Fund.” Yay, ESG!

Politicians took aim

In 2020 we’ll surely reach a frenzy of crossover between the political spheres and the investing spheres

Most notable for us in 2019 were:

Widespread challenges to consumerism & wealth in general

Warren’s sustained attack on private equity.

Discourse on medicare for all, with the most critical distinction for healthcare firms being whether private insurance would remain a thing under new healthcare legislation plans.

On the esoteric side, discussions of tax changes, including the taxation of unrealized capital gains, remained fringe but front of mind for us, considering how monumental a shift that would be.

Cryptocurrencies refused to die and go away

Despite getting walloped in 2018 and starting 2019 out at a dismal price level of ~ $3,000 (down from a high of ~ $20,000), Bitcoin rallied for much of 2019, cresting back over $10,000 at one point.

This trend is in keeping with an overall correlation between Bitcoin and other stores of value (e.g. gold) as well as risk assets overall (e.g. the S&P 500)

Introducing some demographics, at year end, Charles Schwab released data that shows that a Bitcoin ETF is the 5th most popular holding in millennials’ who have a self-directed 401k account with the brokerage (behind more mundane holdings like Amazon stock).

Last but not least, the U.S. economy didn’t enter into recession

That is despite the evergreen calls for these types of things to happen with some timetable esque regularity.

And that is also despite all the public pessimism re: a trade war with China and economic malaise throughout the rest of the globe.

Maybe the U.S. economy is a standout strength after all? We should at least consider it.

Either way, the U.S. didn’t enter recession at all in the last decade.

& yet, in case you needed more proof that the media drumbeat can influence people’s perception of the real economy, we recently talked to a CEO who mused aloud “If a recession does come in 2020…”

Friends Doing Cool Things

Mark’s brother, Jack is shipping out to London for 2020. We wish him all the best and request a notice once it’s okay for us to show up on his doorstep.

Maarten D is writing a paper on real estate allocations + tax benefits for HBS. We read it — it’s great. Inquire if interested.

We’re not the only ones framing investing topics with Zen koans, apparently. Check out this great note from ET. They’re not our “friends” yet, but we’re working on it.

We wish you whatever your heart desires in 2020 (except you, bitcoin maximalists).

Until then, rest up & harvest your tax losses wisely.

Our best,

N + M